Do you need strategic financial leadership without the cost of a full-time CFO?

Drive Your Business Forward with Strategic CFO Expertise.

Elevate Your Financial Strategy to Maximize Profits and Accelerate Growth.

FEATURES

Do you lack real-time financial insights to make informed decisions?

Strategic Financial Planning and Analysis

We collaborate with you to develop financial strategies that align with company goals. This encompasses budgeting, forecasting, and financial modeling to support informed decision-making and sustainable growth.

Risk Management and Strategic Advisory

Identifying and mitigating financial risks is crucial. Our team assesses potential threats and works with you to implement strategies to safeguard assets, ensuring long-term viability. We also offer strategic advice on business expansions, mergers, acquisitions, and other significant financial decisions.

Operational

Oversight & Advisory

We provide oversight to ensure accurate financial reporting, effective cash flow management, and regulatory compliance. We advise on optimizing financial processes and systems to enhance efficiency

ABOUT US

Is your business facing challenges in scaling operations efficiently?

Timely and accurate financial data is crucial for decision-making. A fractional CFO ensures you have the necessary insights to steer your business effectively.

SERVICES

Are you encountering difficulties in managing cash flow effectively?

Shift from Financial Stress to Business Growth

Fractional CFO

Unlock your business's full potential with our fractional CFO services, providing expert financial leadership tailored to your needs. We address challenges such as cash flow management, strategic financial planning, and navigating complex financial regulations, ensuring your business operates smoothly and profitably. Partner with us to gain strategic insights and effective financial management without the commitment of a full-time hire, driving sustainable growth and success.

Exit Planning

Ensure a seamless transition with our comprehensive exit planning services, designed to maximize your business's value and secure your legacy. We address challenges such as identifying value gaps, ensuring business continuity, and minimizing tax liabilities, all while aligning with your personal and financial goals. Partner with us to navigate the complexities of succession planning and achieve a successful, stress-free exit.

DISPLAY HIGHLIGHTS

Is your business experiencing rapid growth without a clear financial strategy?

Integrating with the Team

Relationships & Attentiveness

in-Depth Knowledge

Acting as a Force Multiplier

Steering the Business

Driving Decision Making

Your Partner in Growth

Scalable Financial Foundation

OUR BLOG

Latest Updates & Blog Posts.

Scaling Your Business Without Losing Financial Control

Scaling Your Business Without Losing Financial Control

Introduction:

Scaling a business is one of the most exciting milestones for any entrepreneur. Whether it’s expanding to new markets, launching a new product, or increasing your team, growth signifies success. However, with growth comes complexity—especially when it comes to finances. Without proper systems and strategies in place, scaling can lead to financial disarray, cash flow issues, and operational inefficiencies that could derail your progress.The Importance of Financial Control During Growth:

When businesses grow, so do their financial needs. New hires, expanded inventory, and increased operational expenses are just a few of the costs that accompany scaling. Without clear financial oversight, these expenses can quickly outpace revenue growth, leading to cash flow crunches. It’s not uncommon for businesses to experience “growing pains” where their financial systems struggle to keep up with the demands of scaling operations.Key Challenges of Scaling:

One major challenge businesses face when scaling is accurately forecasting revenue and expenses. Growth often comes with upfront investments that can take time to pay off. For example, hiring new employees to handle increased demand might strain payroll before their contributions translate into additional revenue. Similarly, expanding inventory might tie up cash that could be used elsewhere in the business. Managing these financial dynamics requires a clear understanding of your business’s financial health and the ability to plan strategically.Strategies for Maintaining Financial Control:

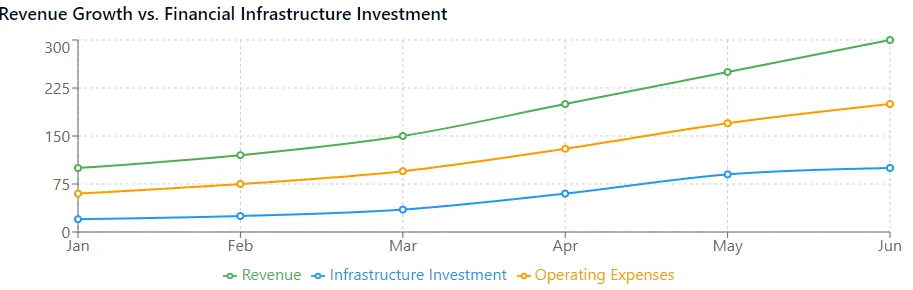

To scale successfully, businesses must prioritize financial planning and accountability. Start by implementing regular financial reporting to track performance and cash flow trends. A well-maintained budget is another critical tool—it helps ensure your spending aligns with your growth goals. Consider using financial forecasting to anticipate future revenue and expenses, allowing you to make informed decisions about hiring, inventory, or investment opportunities. Businesses that invest in their financial infrastructure early are better equipped to handle the challenges of scaling.How a Fractional CFO Can Help:

For many growing businesses, maintaining financial control requires more expertise than their internal resources can provide. This is where a fractional CFO can be invaluable. Fractional CFOs bring experienced financial leadership to your business without the cost of a full-time hire. They can help implement financial systems, manage cash flow, create detailed forecasts, and guide your strategic growth efforts. With their support, you can focus on expanding your business while ensuring your finances remain strong and sustainable.About AmbitionCFO:

At AmbitionCFO, we specialize in providing fractional CFO services that empower businesses to scale confidently. Our team of experienced financial professionals works closely with you to implement the systems and strategies needed to maintain financial control during growth. From forecasting and cash flow management to budgeting and strategic planning, we ensure your business has the financial foundation it needs to succeed. Let us help you turn your growth ambitions into a reality.

Lets Talk ..

By providing my phone number, I agree to receive text and other messages from the business.

Elevating Financial Strategy, Overcoming Challenges, Maximizing Profits & Accelerating Growth with our fractional team of CFO's and Certified Exit Planners

Menu

Links

© 2025 Copywright AmbitionCFO All rights reserved.